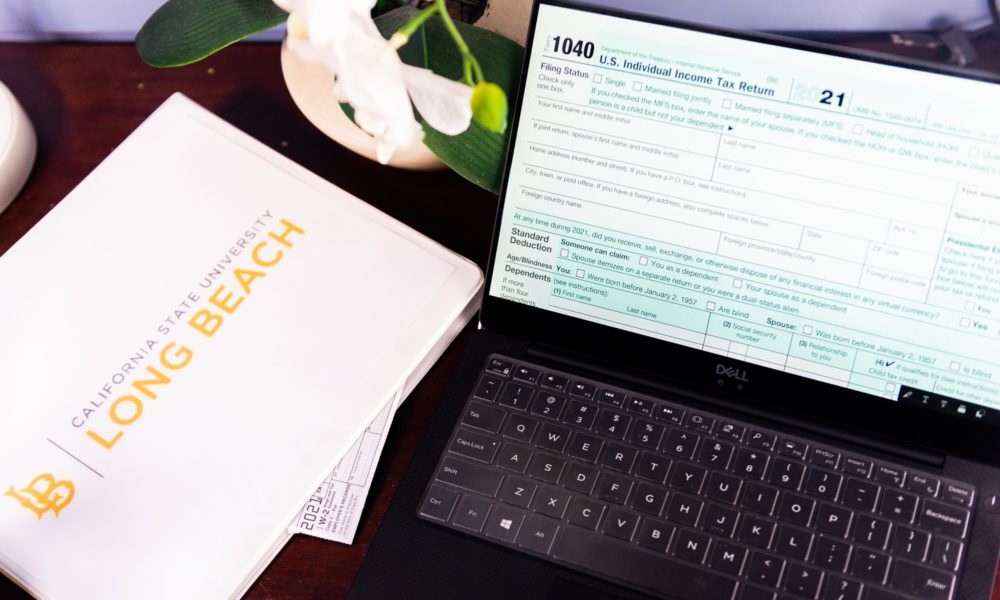

CSULB College of Business (COB) students are offering free tax preparation services for low-income families, non-residents, and the Beach community from now until April 9.

The Internal Revenue Service (IRS) administers the Volunteer Income Tax Assistance (VITA) program, a free tax preparation service to help taxpayers who make less than $58,000, have a disability, or have limited English-speaking skills.

Due to COVID-19 health protocols, taxpayers must schedule a Zoom appointment or a “virtual walk-in” if the hours of operation don’t suit their schedule.

The VITA program facilitates IRS-certified assistance by administering some COB student volunteers involved in the Beta Alpha Psi & Accounting Society and Student Center for Professional Development.

Sudha Krishnan, the CSULB faculty advisor for VITA said CSULB COB students “help the community and gain hands-on experience,” in the press release.

Taxpayers who qualify do not need to live in Long Beach or be CSULB students.

Here is a list of items people should bring for their consultation:

- Government-issued photo ID

- Original social security card or documents

- Individual Taxpayer Identification Number (ITIN) for all family members

- All W-2 and 1099 Forms (if any)

- Other income or expense information

- Tuition fees and expenses paid (Form 1098-T)

- Total expenses paid for child/daycare

- Daycare or dependent care provider’s address, phone, and identifying number (SSN or EIN)

- Bank account and routing number required for direct deposit refund

CSULB’s COB tax preparation services are available from 10 a.m. to 8 p.m. Monday through Thursday and from 9 a.m. to 3 p.m. on Fridays.

For more questions about VITA, contact Nguyet Ngo at [email protected]