President Biden signed a three-part student debt cancellation plan on Aug. 24 that benefits approximately 43 million borrowers and aims to encourage higher rates of college enrollment for low-income students.

His plan will cancel $20,000 of student debt for Pell Grant recipients and $10,000 for non-Pell Grant recipients while extending the pause on student loan payments until December.

“This decision is not for people that have been attending expensive colleges and can afford it,” said Laura Gonzalez, associate professor of finance at Long Beach State. “Since covid has started, especially for first-generation students, [college] registration has declined.”

College enrollment rates in fall 2020 saw the most significant decline since 1951. In July 2020, 39 million college students dropped out of school, and fewer than one million re-enrolled for the fall semester.

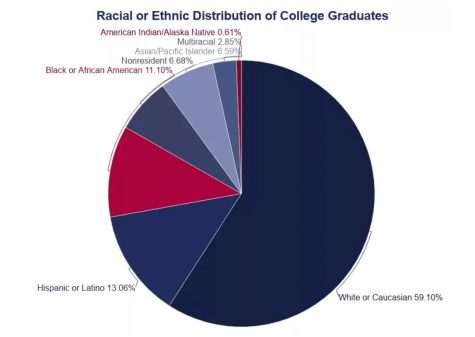

In a study released in June, data showed that students who identified as members of a minority race made up less than half of total college graduates, with white students making up nearly 60%.

The Biden administration aims to close the country’s racial wealth gap by targeting relief for individuals who come from low-income backgrounds.

The White House fact sheet included an Urban Institute study where results found that programs providing debt relief for college Pell Grant recipients could “advance racial equity.”

Approximately 58% of students who identified as Black received the Pell Grant, and 32% of white students received the Pell Grant, a demographic with the lowest recipient percentage, according to the Education Data Initiative,

The high-interest rates on student loan debt, combined with the rate of inflation in health care and the cost of living, have put the United States on track to enter another recession, according to Gonzalez.

“At the time of crisis and growing unemployment, the greatest generation of employment does not come from corporations; it’s actually small businesses,” Gonzalez said.

Earlier this month, Biden signed the Inflation Reduction Act into law on Aug. 16, which created a minimum 15% tax on corporate companies.

Gonzalez anticipated that this new raise on corporate tax has helped the Biden administration find the funds to cancel federal student loan debt.

Gonzalez said that undergraduates are more likely to create new businesses, which will generate more jobs and contribute tax money back into the economy.

With the new student debt cancellation signed into law, Gonzalez said this will encourage individuals to register for college and help them graduate on time.

CSULB offers a Financial Literacy 101 course, which Gonzalez said is a nonpartisan, trusted source of financial information that students may access for free as long as they register before graduating from the university.

Those who have borrowed student loans from the federal government have until the end of 2023 to apply for student debt cancellation. More information is expected to be released in the coming weeks, and borrowers can register here for future notifications.