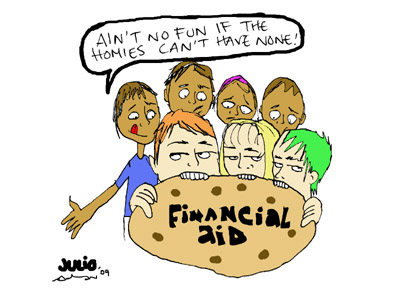

The 2009-2010 financial aid race is on and looks to have fewer winners than in the past. With money drying up faster than a raindrop in the Mojave Desert, many wannabe students will have to put college on hold.

It’s a given that Gov. Arnold Schwarzenegger is playing Robin Hood-in-reverse by slashing recklessly to keep the lights on in Sacramento. His budgetary schema includes chopping Cal Grants, one of the primary funding sources for low- and middle-income college students, many of whom are first-generation minority students.

Schwarzenegger wants to trim the $880 billion per year resources by 10 percent, while the California Faculty Association summarizes that he wants to eliminate the “Cal Grant program entirely.” Approximately 65,500 California State University students receive Cal Grant awards.

Schwarzenegger plans to renege on the Higher Education Compact — an opaque 1984 deal between him and the top dogs of the CSU and University of California systems — for a second year. The “Educ-Hater” wants to blend a $66.3 million mid-year permanent cut to the CSU with a cut of $217.3 million “promised for enrollment growth,” according to the CFA.

The combined formula will equal $283.6 million in CSU cuts. His theory is that now-familiar 10 percent fee increases will generate $131.6 million in “new revenue” to the CSU. The fee increase will be the seventh in eight years, making student fees 135 percent higher than they were in 2002.

The national situation isn’t much prettier. With skyrocketing unemployment, chaos on Wall Street and struggling banking institutions, many people are returning to college to redefine their skills.

Combine returning adults with what might be a bumper crop of graduating high school students and a perfect storm of scarce financial aid can be easily anticipated. The Education Department expects federal financial aid applications to increase 10 percent this year. The feds predict a “$6 billion shortfall in the federal Pell Grant program,” according to the Fort Worth Star-Telegram.

With the current crisis drying up credit markets, student loans also are harder to secure. One lending company, Graduate Leverage, predicts a multibillion-dollar gap between what students want to borrow and what companies have to lend.

There are several tools students and their parents can add to their financial aid survival kit.

Experts advise students to do their homework. Know the application deadlines. The deadline for the Free Application for Federal Student Aid is June 30, but different states require earlier submission. California’s deadline, for instance, is March 1.

Turning in a FAFSA isn’t a one-time deal; it must be renewed every year. Once a student qualifies for the Pell Grant, they might be eligible for other federal needs-based grants.

Know the obligations of student loans before accepting one. While the temptation might be to accept easy money, loans and interest can accumulate quickly and could take a lifetime to repay.

Be creative and search for private grants and scholarships. Ambitious entrepreneurs can be rewarded. Search websites like FastWeb.com, but be wary of any offer that requires a fee. Those are almost always scams.

Most importantly, communicate with your university financial aid office. They can help immensely with wading through confusing technicalities and often can point you in a direction for other available resources.

Remember that you aren’t the only one in the financial aid race. There are millions of students trying to beat you to the finish line, so an early jump can be an advantage.