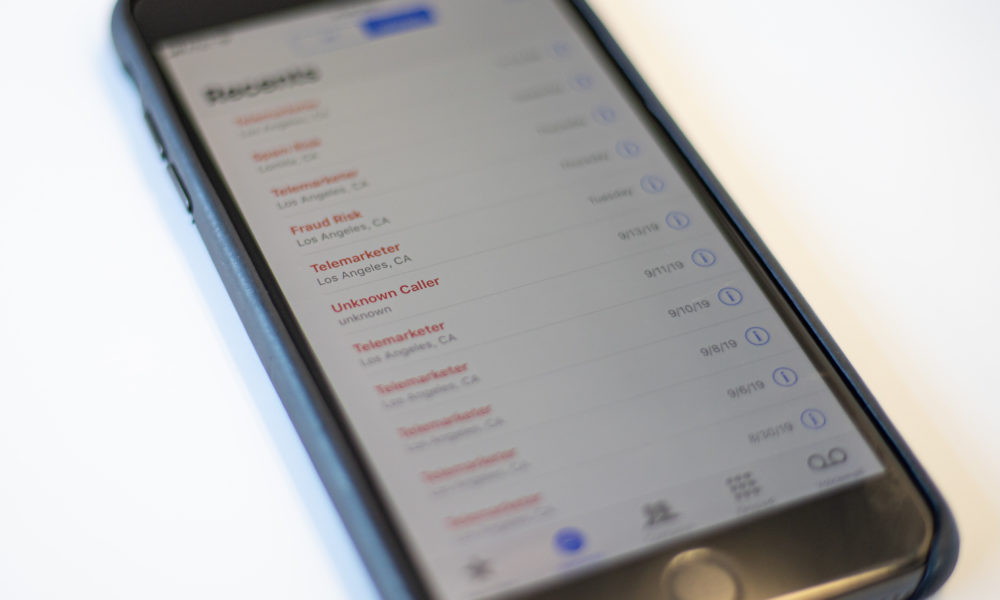

I don’t trust my phone anymore.

It feels like every call I get these days is either a secret telemarketer or survey peddler. If you experience the same paranoia as I do when I see an unrecognized number, you’re another victim of the more than 200 million daily robocalls in the United States. And if you’re anything like me, you’re looking for someone to blame.

In the first days of the Trump presidency, there was a huge groundswell in demonstrations around the country protesting his sexist remarks, Muslim ban, and “The Wall.”

Hidden behind the large and public outcry against the overt positions of the president, Federal Communications Commission Chairman Ajit Pai was already busy changing the face of the FCC with proposed rollbacks of the Telephone Consumer Protection Act.

We need to call on elected officials to limit the effectiveness of corporate lobbying by instituting bans, or ask them to implement legislative workarounds to the outrageous and disastrous Citizens United ruling to get monied interests out of politics. Most importantly, we have to tell them that Pai must go.

The Telephone Consumer Protection Act was passed by Congress in 1991 in response to the new and rapidly expanding use of automated phone equipment. Per the FCC, its main goals were to “[restrict] the making of telemarketing calls and the use of automatic telephone dialing systems and artificial or prerecorded voice messages.”

This law also led to the creation of the National Do-Not-Call Registry which allowed consumers to opt-out of most unwanted calls.

But more importantly, the TCPA gave citizens the right to sue offenders for up to $500 or more per violation leading to judgments like this nearly one trillion dollar settlement. This was a big thorn in the side of Pai’s banker friends in the National Association of Federally-Insured Credit Unions and Consumer Bankers Association who wrote to Pai and published articles in support of TCPA’s repeal.

After the 2015 FCC update to TCPA’s rules, it was struck down by a D.C. federal appeals court. The possibility of successfully prosecuting those cases fell dramatically and robocalls rose in response. The majority of robocalls you receive now most likely won’t be from the banks who advocated for this change. Instead, other enterprises who have jumped at the opportunity to turn your cell phone into a sales hotline are responsible for blowing up your missed calls list.

The FCC recently authorized a new caller verification protocol creatively called SHAKEN/STIR (congress loves their acronyms). SHAKEN stands for Signature-based Handling of Asserted Information Using toKENs and STIR is Secure Telephone Identity Revisited and its purpose is to validate incoming calls in an effort to fight call “spoofing.” But it won’t end robocalls and the FCC is not even mandating its use.

Pai and the FCC’s shenanigans surrounding robocalling is a parable for our age that anyone with a cellphone should know and be mad as hell about. Big money interests, mostly those involved in banking and investments, have installed their puppet as the chair of the FCC.

As call spoofing and the golden age of robocalls vanish from the collective consciousness of our generation, the damage inflicted to TCPA won’t go with it. That means bad news for anyone carrying debt including the nearly 69% of college students such as myself who have taken out loans to pay for school. You can expect the decrease in scam calls to coincide with a distinct rise in debt collection robocalls.

With confidence in lawmakers near an all-time low, it can feel like our only solution is to dump our phones into the ocean and refuse to take any more calls at all.