Cal State Long Beach President F. King Alexander’s struggle with private lenders and a reluctant Congress over student loans has come to an end in what he described as a 15-year fight on a “bloody battlefield.”

Beginning in fall 2009, all student loans offered by the financial aid office will be exclusively funded through the U.S. Department of Education as part of the Federal Direct Loan Program, effectively cutting private lenders out of the student-loan equation.

CSULB has traditionally participated in the Federal Family Education Loan Program (FFELP)—a program created in 1965 by Congress—where funds for loans are provided by private lenders and guaranteed by the federal government.

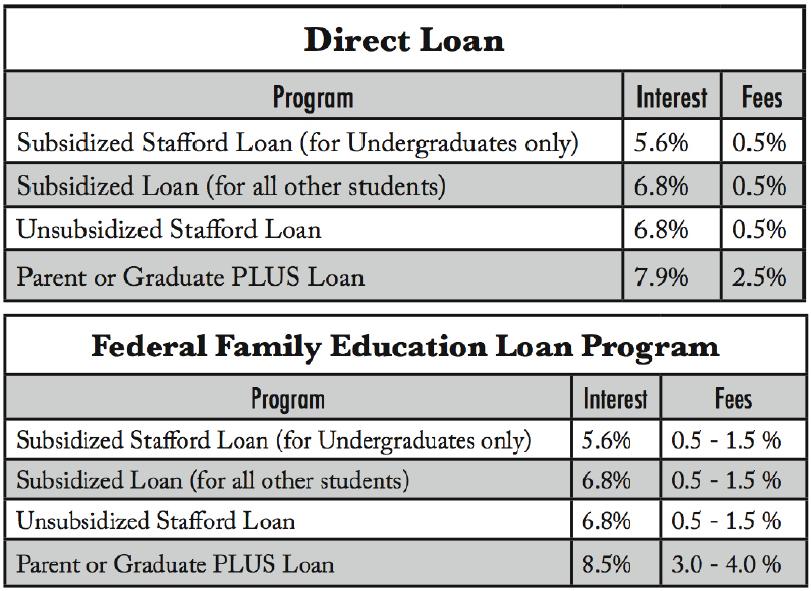

Interest rates for direct-subsidized and unsubsidized loans will remain unchanged, according to Enrollment Services. Processing and origination fees will be fixed at 0.5 percent after a 1 percent Direct Loan Fee Rebate.

During the first year of repayment, however, if a student is late on a payment the rebate is revoked.

Fees imposed by private lenders and banks varied from 0.5 percent up to 2.5 percent, according to Nicolas Valdivia, director of financial aid.

Under FFELP, banks and other lenders had little to no risk while taking on student loans since the federal government purchased defaulted loans.

Banks “have been playing far too big of a role in policy development,” Alexander said. “They’ve just been making free money forever—billions and billions of free dollars.”

Michael Solt, dean of the CSULB College of Business Administration, said direct lending “cuts out the middle party that’s extracting some profits” and increases the “efficiency of the whole economic system.”

“Banks deserve profits for what they do,” Solt said. “But whether this is the right place for them to profit at the expense of students and parents, I’m not so sure.”

Continuing students with loans will have to pay back at least two loans after a 6-month grace period following graduation or dropping below half-time enrollment.

Students can also choose to consolidate their loans into one monthly payment upon repayment through the Federal Direct Consolidation Loan program or through a private lender.

“I think consolidating can reduce the monthly expenses,” Solt said. “But again, going through the banks versus going through the government, my guess would be the government would be a lower-cost way to go because they’re charging a lower interest rate.”

President Barack Obama said during an April 24 news conference that banks and lenders are mobilizing “an army of lobbyists to try to keep things the way they are.”

Alexander agrees.

“This is a big battle,” he said. “It may be the last time that their lobbyists are going to be all over [Capitol] Hill trying to stop us from getting something done.”

The battle may have already been decided, as CSULB is just one of many universities opting to remove private lenders from its student loan process.

“I know that of the CSU institutions, about 11 have gone” to direct lending, Alexander said. “The rest of us are going right now.”

The switch is an issue Alexander has been working toward for nearly two decades. But recent delays from lenders have sparked more immediate action.

Valdivia said at least two lenders were unable to send funds to CSULB on time. As a result students experienced delays in receiving their money.

Valdivia would not comment on which lenders the affected students used.

The Obama administration estimates that eliminating the FFELP program will save $48 billion over the next decade. In total, implementing Obama’s proposal could save approximately $94 billion over the same amount of time, according to the Congressional Budget Office.

Part of Obama’s proposal would use the billions in savings to increase Pell Grants, as well as place the grants at a fixed rate above inflation for low-income students.

In 1995, banks successfully lobbied to limit the amount of schools that could switch to Federal Direct Loans.

“Now there’s no indication that that’s going to happen [again],” Alexander said. “Because you have the president in favor of it, secretary of education in favor of it and Congress majority in favor of it. The only people that are not in favor of it are the banks.”

A Republican-run Congress blocked President Bill Clinton’s Direct Loan initiative by only allowing about 25 percent of all higher education institutions to participate in the program, Alexander said.

“The Republicans have been very interested in protecting the banks and the private lenders,” Alexander said. “The difference is now they don’t have Congress to put limits on how many schools can go” to Federal Direct Loans.

Alexander estimates that currently 35 percent of institutions have gone to direct lending.

“It’s better for our students to go in this direction,” Alexander said. “There is no chance the rug is going to be yanked out from under us.”

The goverment direct loan rate is 7.5% on my daugher’s loan while she is getting 2.5 % on the bank loan through AES with rate that is based on prime minus. The government will have my daughter in debt much longer than the bank. A big favor they did!! It is cheaper to buy a house than pay for your student loan. My Senators Bob Casey and Arland Spector would not return my calls as well as Congressman Todd Platts to discuss this difference.