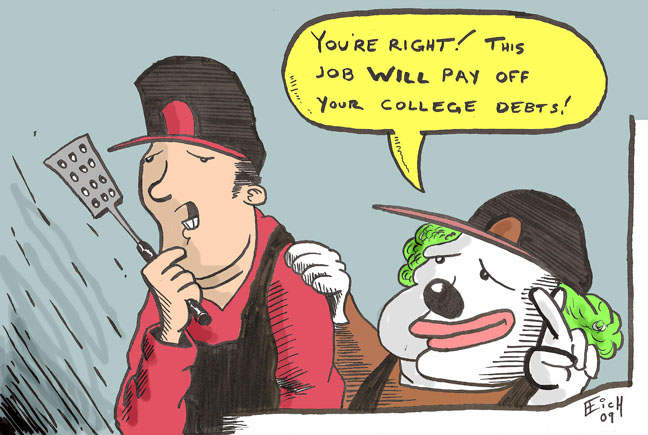

Students are demanding their employers pay them less — yes, less — and when turned away are quitting. This comes in the wake of a new federal loan program. Recently addressed in The New York Times, the Income Based Repayment program has been shrewdly exploited by America’s student population.

The IBR program is fairly simple; a direct student loan from the federal government through its well-endowed Department of Education — the money here is not borrowed from the likes of Bank of America and Citigroup but Uncle Sam, himself. The cool thing about IBR is in the name; students pay their loans back at a cost “based” on their income and family size, not on credit rating and credit history.

This minor detail, seemingly overlooked by the always-clever boys and girls in Washington, D.C., has created a demand for lower paying jobs.

With current economic conditions worsening to include, but not limited to, wavering job security, high gas prices, the weakening of the dollar, high tuition costs and a host of other economic factors, American students are fighting fire with fire and playing footsie with poverty. When in Rome, right?

Seriously, it would be dumb not to take advantage of a program like this? Amazingly, IBR actually recalculates the borrower’s annual repayment, charging 15 percent of the difference between a borrower’s Adjusted Gross Income — that’s your gross income after approved tax deductions — and 150 percent of the Department of Health and Human Services Poverty Guidelines, after adjustments for family size.

To put it simply, that means the less you make, the less you have to pay Uncle Sam at the end of the month. Truly, the program is a monument to American fiscal responsibility.

In reality, you probably won’t see students lining up at local Wal-Marts or McDonald’s restaurants because their current job pays too much. Ignorance, though, sometimes makes students appear stupid — especially in the financial world.

According to a 2002 study, 64 percent of students graduate with debt. Of that 64 percent, 39 percent have loans that are unmanageable, meaning their accumulated debt is more than 8 percent of their yearly income before taxes. In light of such figures, IBR comes as a lifeline to those who simply cannot pay off their loans.

Once an IBR loan is taken on, one of three things can happen:

Firstly, the student will pay the loan back and, because of the lowered payments, accrue more interest than the original loan. That’s fine because he or she probably couldn’t have paid the loan otherwise.

In the second scenario, the student continues repaying the loan but, because of his or her income status, is mathematically unable to pay the loan back within 25 years. Here, the federal government may forgive the debt if certain conditions are met.

The other outcome could be that the student, while paying the loan, begins working a public interest job. Here, the loan can be forgiven if not repaid within 10 years of the start of the loan.

IBR is a great step toward managing student debt, but it must be understood that whatever terms and conditions a loan may have, one must always understand its risk is not diminished.

IBR adjusts its monthly repayment to work with a student’s income, effectively making it easier to pay the loan back. Nevertheless, students shouldn’t blow presumed “extra” money on items that are simply beyond their means.

For example, according to studentaid.ed.gov, a student who graduates to make $30,000 a year will make a $172 monthly payment on a loan. That’s a cool $2,064 a year, or about 7 percent of that student’s income.

The point is, these new loan easements are not the “real world’s” free pass but could be a helpful push in dealing with the crazy world of student debt — if students understand the consequences.

E-mail addresses are used only to notify you of replies and are not displayed

Comments powered by Disqus