Managing your personal finances while being a student can be difficult. It takes some prior skill and knowledge, but receiving adequate information can facilitate that.

While treating yourself to something special can be rewarding, managing your money will be more beneficial in the end.

Making wise financial choices and keeping your own records can help you manage life during and after college. Planning ahead and initiating early savings can help position students for financial and academic success.

Taking on many different responsibilities throughout the semester has been a challenge. I am working a part-time job, taking on an internship and running a small business. I also do research for 18th-century magazines on campus, analyzing literature from old magazines.

Being a young adult in a trend-driven society sometimes influences me to shop too much. Whether it’s on beauty products, the latest fashion, restaurants or aesthetically pleasing coffee shops that I saw on social media, I am constantly looking to try new things.

From working nonstop to saving money on the side, college students are more than aware of the challenges that might arise when it comes to managing their finances, like frequent price fluctuations.

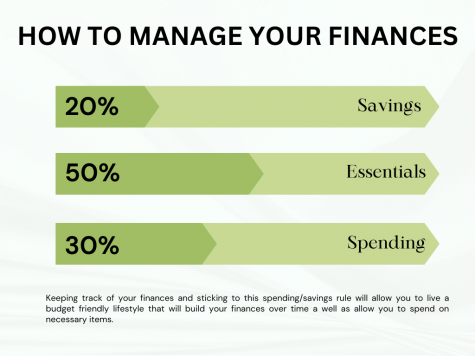

I try to follow healthy habits when it comes to my money management. One way I do this is by sectioning out my sources of income, saving one half and spending the other on utilities, food, outings and shopping. I also try not to shop as frequently, but when I do, I reward myself for my hard work.

Since I am also a full-time student, there are moments when I cannot work as much. When it comes to times like these, I like to stick to the saving rule of putting aside 20% of my own money into savings. This way, I am paying myself first.

“One of my biggest challenges would be impulsive buying and then facing unexpected costs when life throws a curveball at you,” Megan Weatherspoon, a third-year art major said.

Much like Weatherspoon, one of the main struggles that I have when it comes to managing my finances is limiting my impulsive spending.

“I first learned about money saving at my community college when I took a personal finance class,” Weatherspoon said. “I learned to have a percentage for everyday needs, wants and necessities, and I try to follow that rule and save as much as I can.”

If you are just starting your financial journey, you might benefit from taking low-cost online courses, attending seminars with financial experts and downloading finance applications like PocketGuard and Mint.

There are also some great books out there that can help strengthen your knowledge and encourage you to start building your own wealth. Some examples include “Rich Dad Poor Dad” by Robert Kiyosaki and “The Total Money Makeover” by Dave Ramsey.

Laura Miguel, a first-year CSULB student, received her mother’s guidance when it comes to managing her money. When she received her FAFSA reimbursement earlier in the semester, her mom was quick to tell her what to do.

“She passed down her knowledge to me,” Miguel said. “She sat me down and helped me open up a savings account, and she helped me portion out my money so it could last longer.”

Handling your money and eventually reaching the point of investing and growing your wealth might be intimidating at first. However, if you start now during your college years, it will benefit you later on.